GTA REALTORS® Report Mid-Month Resale Housing Market Figures

TORONTO, January 19, 2011 -- Greater Toronto REALTORS® reported 1,563 sales during the first two weeks of January 2011 – an 11 per cent decrease compared to the first two weeks of January 2010.

The bulk of the sales are in the 905 areas. This is where we also see the highest price increases. Detached house prices in the 416 area actually decreased.

"While off the record pace experienced last January, sales remain high from a historic perspective and market conditions remain tight enough to support a sustainable rate of price growth," said Toronto Real Estate Board (TREB) President Bill Johnston.

|

|

The average price for transactions during the first 14 days of January was $413,565, representing a five per cent increase compared to the first two weeks of January 2010.

"Average price growth continues to be supported by a positive affordability picture. A household earning the average income can afford mortgage payments associated with the purchase of an average priced home," said Jason Mercer, TREB's Senior Manager of Market Analysis.

GTA Rental Market Figures

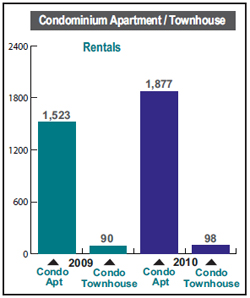

TORONTO, January 19, 2011 - From September until the end of 2010, TREB Members reported 4,920 rental transactions for condominium apartments and townhouses, representing a 27 per cent increase from the 3,859 transactions recorded during the same time period in 2009. There were a total of 9,227 apartments and townhouses listed for rent during the reporting period, representing a 22 per cent increase compared to the last four months of 2009.

There was substantial growth in condominium apartment completions in 2010, which explains the strong growth in the number listings that were available during the reporting period.

Many of the condominium apartments that were completed over the past year were owned by investors. Some of these investors chose to list their units for rent.

While the number of units listed for rent increased strongly on the Toronto MLS® system, it is important to note that the number of rental transactions actually increased at a greater rate.

The number of households signing lease agreements in the last four months of 2010 more than accounted for the increase in supply.

For an in-depth view of condominium apartment completions in 2010, for the GTA and constituent municipalities, consult the following report: CMHC, January 2011, "Housing Market Tables, Selected South Central Ontario" at http://www.cmhcschl.gc.ca/odpub/esub/64679/64679_2011_M01.pdf.

Central Area

• In TREB’s Central districts, 1,760 one-bedroom apartments rented for an average of $1,555 per Month - up one per cent over last year’s average of $1,540per month.

In addition, 1,053 two-bedroom apartments were rented for an average rent of $2,193 per month – a one per cent increase over the 2009 average of $2,174 per month.

• There were 78 townhouse rentals in the Central districts, including 33 three-bedroom units, which rented for an average of $2,626 per month – down four per cent from last year’s average of $2,725 per month.

North Area

• There were 195 one-bedroom apartments leased in TREB’s North districts for an average rent of $1,346 per month - up two per cent from last year’s average of $1,318 per month.

There were 198 two bedroom apartments rented for an average of $1,721 per month - up one per cent from the average of $1,703 per month recorded during the last four months of 2009.

• A total of 56 townhouse units were rented in TREB’s North districts. The majority were three bedroom units, which rented for an average of $1,781 per month - a marginal decline from last year’s average of $1,788 per month.

East Area

There were 107 one-bedroom apartments and 146 two bedroom apartments rented in TREB’s East Districts. The average rent for one-bedroom apartments was $1,242 per month, down one per cent from the $1,259 per month recorded for the same period last year. The average rent for two bedroom apartments was $1,505 per month – up marginally from last year’s figure of $1,501 per month.

• There were 34 townhouses leased in TREB’s East districts. Of these, 25 were three bedroom units, which rented for an average of $1,512 per month – up nine per cent from an average of $1,392 per month last year.

West Area

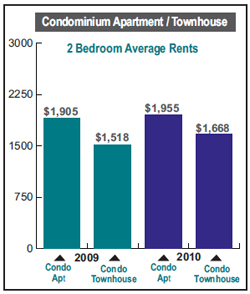

• There were 930 apartment rentals in TREB’s West districts during the last reporting period. Of these, 406 were one-bedroom apartments, which rented for an average of $1,364 per month – up five per cent from the average of $1,296 in 2009. There were 480 two bedroom apartments leased, which rented for an average price of $1,668 per month – a two per cent increase compared to the average of $1,640 per month in 2009.

• The West districts led the GTA in townhouse rentals, with 175 in total. Of these, 127 were three bedroom units, which rented for an average of $1,599 per month – up two per cent from last year’s average of $1,563 per month.

Tightening of mortgage rules to combat our increasing personal debt

In an attempt to curb excessive borrowing by Canadians, the federal government is eliminating 35-year mortgages for people who need mortgage insurance, lowering the amounts for mortgage refinancing and removing government insurance for lenders selling equity lines of credit to clients.

There's a great fear that Canadians are headed for trouble once interest rates start rising. And rise they must…

To be able to qualify for a mortgage that will cover the constant increases in house prices, many buyers have been opting for a 35 year amortization, lowering the monthly payments…also increasing the amount of overall interest on a loan.

For example, a $100,000 mortgage with a variable-rate mortgage of 2.3 per cent:

Over 35 years costs $346.29 per month with $190.75 interest, $155.54 paying down the principal.

Over 30 years costs $384.24 per month with $190.75 to interest, 4193.50 paying down the principal

Over 25 years: costs $438.07 per month with $190.75 interest and $247.32 paying down the principal.

The lower amortization comes into effect March 18th for buyers with less than a 20% down payment. It will greatly reduce the amount of interest paid over the life of a mortgage and make it easier to build equity.

In addition, on April 18th, the government is lowering the maximum people can borrow through refinancing their mortgages to 85 per cent of the value of their home, down from 90 per cent.

This kind of refinancing has been popular with homeowners who have multiple debts, including high interest (19-22%) credit card debt. The debts are rolled into the mortgage at a much lower rate and can be paid down more quickly. However, the borrowers house is on the line, and equity in the house has been considerably reduced. The problems could start if the borrower defaults, if the home loses considerable value due to a downturn in the market, or if interest rates are hiked.

Up until now, the government has provided insurance to lenders for these lines of credit. Now this insurance is being withdrawn. It’s safe to assume that lenders will be tougher as to who can qualify. Borrowers who already have home equity lines of credit will not be affected.

Home-equity lines of credit and loans have surged in Canada, rising at almost twice the pace of mortgages over the past decade to account now for 12 per cent of overall household debt.

In 2008, Mr. Flaherty announced Ottawa would no longer back 40-year amortizations, with a goal of cooling down a hot real estate market and preventing the emergence of a housing bubble in Canada. At that time, the government said it would also back only mortgages where the buyer has put down at least 5 per cent, effectively eliminating zero-down mortgages.

Last February the Finance Department lowered the maximum amount Canadians could withdraw in refinancing their mortgages to 90 per cent from 95 per cent of the value of their homes. Mr. Flaherty also introduced a measure requiring borrowers to qualify for a five-year fixed-rate mortgage, even if they sought a variable mortgage at a lower rate. Until that change, home buyers only had to qualify for the higher of either a three-year fixed-rate or variable-rate mortgage.

First time buyers move the market, their purchases having a domino effect as the sellers move up and down the property ladder. Tougher qualifications for first time buyers presumably will have a dampening effect on the market. We are already seeing sales down across the GTA by 11%. Prices rise because of the lack of viable product. I gasp sometimes when I see asking prices on some places…I think that buyers are exercising more caution overall.

There are still properties that sell sometimes as much as $100,000 over asking…this is purely the result of a ridiculously low asking price on a scarce home, making the purchase an emotional one look at past sale prices to get an idea of the amount a property will sell for. If it seems like it’s too good a deal to be true, it probably is!

That’s all for now. Contact me with any queries you may have.

Kind regards,

Louisa